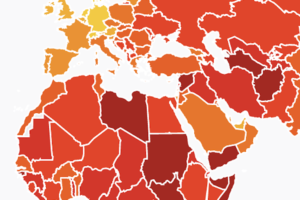

A new report from Transparency International finds that corruption levels have increased around the world, including in some of the countries that have typically scored well, such as Canada, Australia, and the United States. Indeed, among the top 25 least corrupt countries, according to TI’s Corruption Perception Index (CPI), 15 had lower scores in this year’s report than they did in 2012.

The CPI ranks 180 countries by their perceived levels of public sector corruption, according to experts and businesspeople. For risk management and internal audit professionals, the report provides a valuable input to prioritize anti-fraud efforts and perform risk and fraud risk assessment. The CPI Index uses a scale from 0 to 100. 100 is very clean, 0 is highly corrupt.

In this latest publication, the top countries on the CPI are Denmark and New Zealand, with scores of 88, followed by Finland, Singapore, Sweden, and Switzerland, with scores of 85 each. The bottom countries are South Sudan and Somalia, with scores of 12 each, followed by Syria (14), Yemen (15) and Venezuela (15).

The index also highlighted a troubling steady decline in corruption scores, even as many nations have worked to rein in corruption in recent years. According to the report, some countries that have typically fared well on the index have experienced lower scores. For example, the United States has slipped 6 points from a 73 in 2012 to a 67 this year. Meanwhile, Australia has slipped 8 points to 77 during that period, Canada declined 7 points, and Finland—a perennial leader in anti-corruption fell 5 points.

Other notable countries include Brazil, which sored a 38 putting it 94th on the list; China, which scored a 42, putting it in 78th place, and Russia, far down the list with a 30 or 129 on the list of 180 nations.

Corruption and the Pandemic

In the context of the COVID-19 pandemic, the report should generate extra-attention given the likelihood that corruption shifts public spending away from essential public services. According to Transparency International “countries with higher levels of corruption, regardless of economic development, tend to spend less on health.”

Corruption is defined by the Association of Fraud Examiner (ACFE) as any wrongful acts designed to cause unfair advantage. It takes many forms–bribery, kickbacks, illegal gratuities, economic extortion, and collusion.

Informing Compliance and Internal Audit

In most companies, the CPI statistics is a core parameter for the design of compliance and anti-corruption fraud program, and the index can be used to inform those programs. Countries with a higher index are categorized as high risk leading to a higher degree of scrutiny during the opening of a legal entity, or the onboarding of suppliers and customers.

The CPI index provides internal auditors with a solid red flag on corruption and a critical input for the design of internal audit programs. As an auditor, understanding and evaluating the risk of fraud is a core professional responsibility. The latest ACFE 2020 Report to the Nations reveals that 43 percent of occupational fraud is committed through corruption with a median loss of $200,000. The frequency, average financial damage, reputation, and legal consequences are consequent. The reputational and legal risks from legislations such as the U.S. Foreign Corrupt Practice Act and the U.K. Bribery act highlight the need for internal audit vigilance with regards to the effectiveness of anti-corruption controls.

Internal auditors performing reviews should consider the CPI index during the elaboration of their audit plans and must integrate testing’s around the potential occurrence of corrupt payments if the index is below a certain threshold, such as 50. Any tangible benefit given or received by your organization with the intent to corruptly influence a counterpart can be an illegal payment.

The methods of payments requiring a vigilance are gifts, travel, entertainment., cash payments, and promises for favorable treatment. Counterparts are employees, contractors, government agencies, sales intermediaries, and logistic brokers. It is highly recommended to integrate anti-fraud checks on payment to analyze payment to out-of-country accounts, or free-text payment descriptions for high-risk keywords such as “expedite fee,” “facilitation payment,” or government liaison names. Such alert controls can now be easily automated with the use of technology such as robotic process automation (RPA).

Finally, the CPI Index published recently shows that two-thirds of countries score below 50. The report outlines that “despite some progress, most countries still fail to tackle corruption effectively.” This should prompt senior managers and auditors to evaluate the existence of adequate anti-fraud controls such as a strong tone at the top, a code of conduct, an anti-fraud policy, a periodic fraud awareness training program, an effective ethics or whistleblower hotline to obtain tips, and a truly independent internal audit department. ![]()

Jean-Marie Bequevort is Expert Practice Leader Internal Audit at TriFinance, a consulting company with offices in Belgium, Luxembourg, Netherlands, and Germany.